Picking the Right Markets

Now is the time to buy multifamily real estate.

With over twenty years’ experience in multifamily real estate investing and a team with $3.5B of transaction volume, we at Faulkner Capital Partners have learned how to invest in the right markets at the right time.

To discuss market timing, we must review three main factors…

Capital Markets/Macroeconomic – factors that affect the cost of capital (to buy and own) and liquidity (ability to sell) of multifamily real estate.

Multifamily Operating Fundamentals – factors that affect the performance of the cash flows of multifamily assets.

National, State, and Local Regulatory Risks

The variables that influence these factors can be tracked! And since the nature of real estate provides for a slow transaction process…it gives the ability to see the relevant indicators relating to cyclical trends almost in Real Time!

PICKING THE RIGHT MARKETS…AT THE RIGHT TIME

We assess supply and demand indicators to sequence market entry timing.

We prioritize markets where:

Supply being delivered has fallen

New construction starts are low

Concessions are present but shrinking

Rent growth has been low/negative but is crossing back to positive

Transaction pricing shows narrowing in the bid vs ask and volume starting to increase off a low period

However, to pick markets, we need to define them and understand how they work.

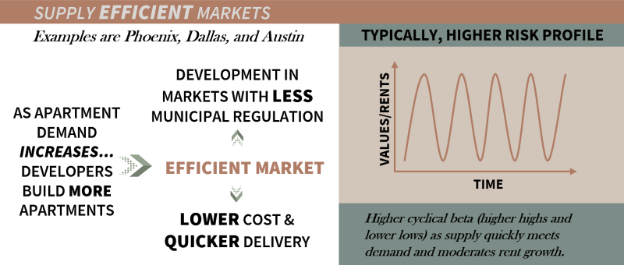

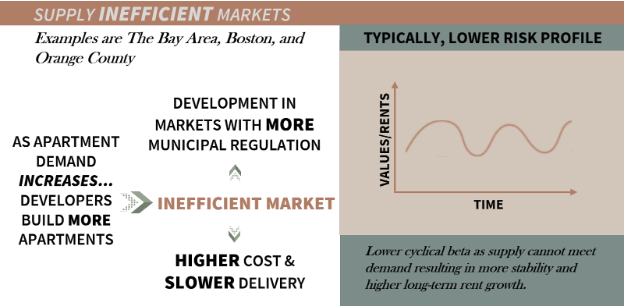

The most important thing to focus on when deciding which market (or state) to invest in is the ability to add supply or better known as the market’s SUPPLY EFFICIENCY.

Both efficient and inefficient markets are investable. BUT IT IS EXTREMELY IMPORTANT TO UNDERSTAND where each market is at in terms of their supply cycle.