Capital Markets

Now is the time to buy multifamily real estate.

With over twenty years’ experience in multifamily real estate investing and a team with $3.5B of transaction volume, we at Faulkner Capital Partners have learned how to invest in the right markets at the right time.

To discuss market timing, we must review three main factors…

Capital Markets/Macroeconomic – factors that affect the cost of capital (to buy and own) and liquidity (ability to sell) of multifamily real estate.

Multifamily Operating Fundamentals – factors that affect the performance of the cash flows of multifamily assets.

National, State, and Local Regulatory Risks

The variables that influence these factors can be tracked! And since the nature of real estate provides for a slow transaction process…it gives the ability to see the relevant indicators relating to cyclical trends almost in Real Time!

CAPITAL MARKETS/MACROECONOMIC – Market Timing Factor 1

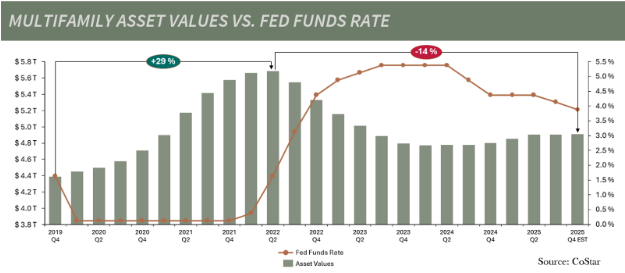

In multifamily real estate values, we saw a bottom two years ago – occurring sometime between 3Q 2023 to 1Q 2024. Values have been stable since then. The primary variable that led to the disruption in multifamily values was the dramatic increase in interest rates from mid-2022 to early 2023. Due to interest rate increases, the relative yield in the greater investment landscape increased, which caused the values of multifamily assets to decline.

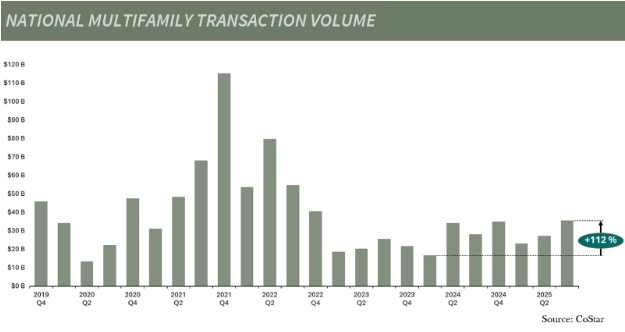

Investors want to see a trough or price reset to come back into the market. Now that this has been clearly identified, we can see transaction volume starting to pick up again. The graph below shows transaction volume bottoming out in 2023 and increasing over the last 18 months.

Once we see transaction volume pick up, then we see an agreement on price, and we see values start to increase. The sequence of these events is shown repeatedly throughout history and indicates the end of price resetting and the beginning of the next growth phase.